bidang unggulan

berita terbaru

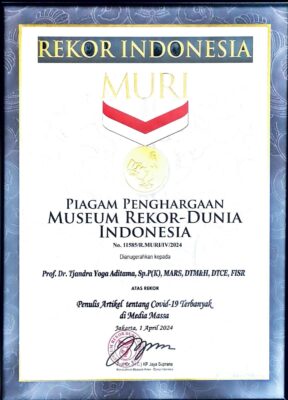

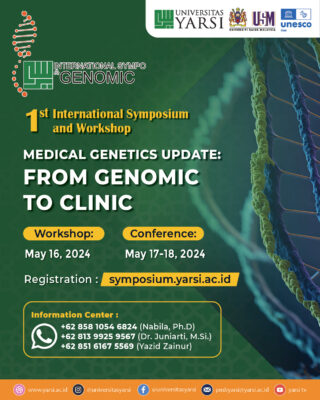

Penelitian Genomic, Yarsi Telah Investasi Milyaran

Indonesia dalam hal penelitian genom (genomic) masih jauh ketinggalan. Buktinya Indonesia belum punya genom Indonesia. [...]

Apr

Milad ke-57 ,Yarsi Harus Jadi Pusat Pembelajaran,Inspirasi serta Berperan di TJSL

Peran mahasiswa Yarsi pada Program Tanggung Jawab Sosial dan Lingkungan (TJSL) sangatlah penting . Pertama, [...]

Apr

Pengabdian Prodi MM dan MKn Yarsi Berbuah, Kini KWK Punya Badan Hukum

Ada banyak cara membantu masyarakat. Sebagai lembaga pendidikan tinggi Program Studi Magister Manajemen (Prodi MM [...]

Mar

International Short Course Fakultas Psikologi YARSI Menghadirkan Narasumber dari 4 Negara

Puji syukur kepada Allah Tuhan yang Maha Esa, Health Psychology International Short Course yang diselenggarakan [...]

Mar

Latih dan Tumbuhkan Kebanggaan Mahasiswa , Prodi TI Gelar Pameran Teknologi

Kecerdasan Buatan (artificial intelligent ), Internet of Things (IoT) dan Pengembangan Aplikasi Mobile sekarang sudah [...]

Mar

Hadirkan Karya Mahasiswa Seputar AI, IoT dan Aplikasi Mobile, FTI Gelar Pameran

Pameran Program Studi Teknologi Informasi (Prodi TI) Universitas Yarsi sudah berlangsung sukses, Selebrasinya ramai pengunjung.dari [...]

Mar

Kolom pakar

Bergabung di sosial Media Kami